Want to boost your financial well-being? With so much happening in the economy lately, it’s more important than ever to stay focused on your financial goals. Staying consistent with your savings, managing debt wisely, and continuing to invest—even during uncertain times—can make a big difference. Here are ten essential tips on budgeting, debt management, and investing to help you build lasting financial stability and growth.

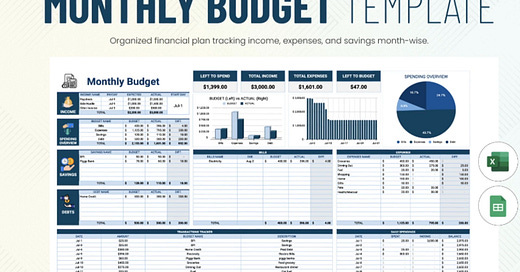

1. Track expenses: Monitor your spending habits to identify areas where you can cut back.

2. Create a budget: Allocate your income toward necessary expenses, savings, and discretionary spending.

3. Pay off high-interest debt: Prioritize paying off debts with the highest interest rates, such as credit cards, to save money in the long run.

4. Consolidate debt: Consider combining multiple debts into a single loan with a lower interest rate to streamline payments and save on interest.

5. Build an emergency fund: Save 3-6 months' worth of living expenses for unforeseen circumstances.

6. Avoid unnecessary borrowing: Limit using credit cards or taking out loans for non-essential purchases.

7. Start investing early: Begin investing as soon as possible to take advantage of compounding interest over time.

8. Diversify your investments: Spread investments across various asset classes to minimize risk and maximize potential returns.

9. Contribute to retirement accounts: Take advantage of tax-deferred growth by contributing to IRAs and 401(k)s.

10. Seek professional advice: Consult with a financial advisor to develop a personalized plan for budgeting, debt management, and investing.

By implementing these finance tips, you can improve your financial well-being, secure your future, and achieve your financial goals. Remember, it's never too early—or too late—to start making smart financial decisions.

Check out more financial tips in our book, The Resolution PACT: The Blueprint to Achieving Health and Wealth Together As A Family, available on Amazon.

Next week’s Substack note will be the final one for the month available to free subscribers. Upcoming content for our paid subscribers includes a spotlight on a local entrepreneur dedicated to sustainability, insights from film and television producers who participated in a 7-month production lab called Wide Angle Project, updates on college sports NIL deals and their potential impact on the fan experience, and travel hacks to keep you thriving in those international streets.

If you’d like to keep receiving our weekly content, consider upgrading to a $5/month or $50/year subscription. Free subscribers will continue to receive one free posting per month.

Share this post